Flooding

According to Pennsylvania’s Emergency Management Agency (PEMA), flooding is already “the most frequent and damaging natural disaster that occurs throughout the Commonwealth,” and may get worse. Penn State research indicates that 6.5% of Pennsylvania’s population (831,000 people) lives in a floodplain, making it crucial that local municipalities start implementing changes to make their communities more flood resilient.

In southwestern Pennsylvania, flooding has ravaged many communities, leaving homes damaged or destroyed. An estimated 41,487 people live in the floodplain (data compiled by SPC in 2018 with 2000 US Census and FEMA data). With increasing frequency and intensity of storms according to National Climate Assessment, this puts these communities at an even greater risk of harm. The tools of floodplain management can be used to mitigate this potential damage. SPC’s Water Resource Center has gathered information to assist communities with the development and implementation of an effective floodplain management program at the local level.

National Flood Insurance Program (NFIP) Background

The United States Congress passed the National Flood Insurance Program Act in 1968 to address the impacts of floods across the nation by:

- Transferring costs of flood losses from taxpayers to property owners in the floodplain

- Providing financial aid after floods

- Guiding development away from flood hazard areas

- Requiring new buildings to be constructed to minimize flood damage

The Federal Emergency Management Agency (FEMA) administers the NFIP with the goal to help communities increase their resilience to disaster through risk analysis, risk reduction and risk insurance. The NFIP helps individual citizens recover from the economic impacts of flood events, while providing a mechanism to reduce exposure to flooding through compliance with building standards and encouraging sound land use decisions.

Most communities joined the NFIP in the 1970s. As of February 2019, 91% (over 22,000) of communities in the United States are part of the NFIP.

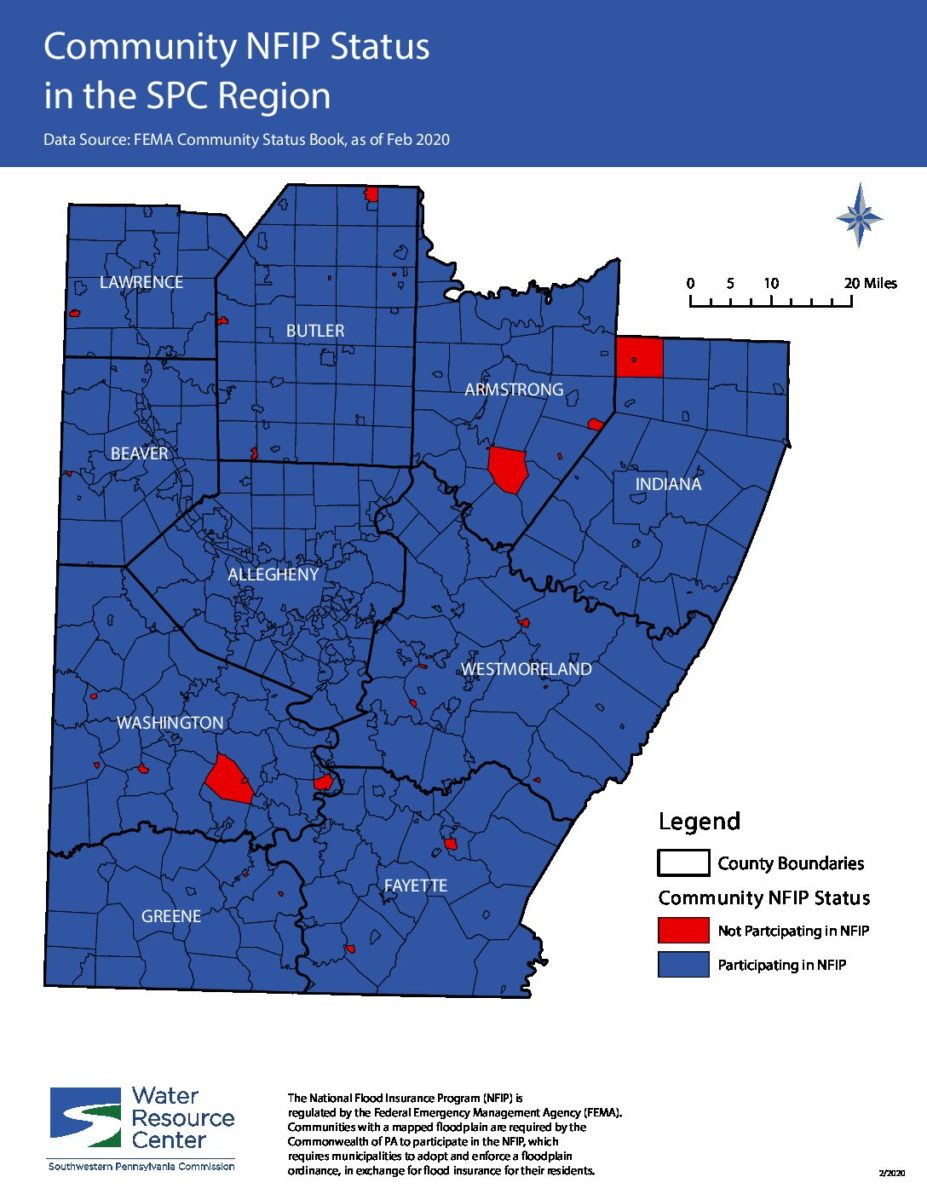

NFIP Communities in SPC Region

Timeline of NFIP Legislation

- 1968: NFIP was created to address the lack of private flood insurance and protection from increased flooding.

- 1973: Flood Insurance Protection Act

- 1994: National Flood Insurance Reform Act – created the Community Rating System

- 2004: Flood Insurance Reform Act

- 2012: Biggert-Waters Flood Insurance Reform Act: The Biggert-Waters Act was one of the larger reforms to the NFIP, aiming to make the NFIP more financially stable. The act created a national mapping program and raised flood insurance rates to reflect homeowners true risk of flooding (rate increases were mainly for properties in Special Flood Hazard Area (SFHA) that were not elevated)

- 2014: Consolidated Appropriations Act and the Homeowner Flood Insurance Affordability Act

For more information, see Federal Flooding Regulations.

NFIP Requirements and Administration

When a community enrolls in the NFIP, they enter into an agreement with the federal government, in which flood insurance is made available if the community regulates development in the floodplain by creating and enforcing a floodplain ordinance. Both governments work together towards successful floodplain management, reducing the risk of flooding for residents and harm to the natural environment. Three key elements to the NFIP are the creation of maps; availability and issuance of flood insurance; and the enforcement of floodplain development regulations.

Mapping

One of the key elements to successful floodplain management is the mapping of the flood hazard areas. For each NFIP community, FEMA creates a Flood Insurance Study (FIS), Flood Profile, Flood Hazard Boundary Map (FHBM), and a Flood Insurance Rate Map (FIRM). The date at which these studies and maps are published is important for grandfathering.

Insurance

Under the NFIP, FEMA requires insurance companies to require property owners with a federally-backed mortgage in the floodplain to obtain flood insurance. Residents do not have to live in the floodplain to obtain flood insurance, though (as long as the community is in the NFIP). The FIRM is used to determine insurance rates, based on the floodplain boundary.

Regulations

The community is required, under the NFIP, to create and enforce a floodplain ordinance that meets or exceeds the requirements of 44 CFR 60.3. This ordinance is used to regulate development in the floodplain to reduce the risk of flood damage. The FIRM is used to determine where the floodplain is, and therefore, what buildings should have higher flood protection. Compliance is regulated by FEMA through Community Assistance Visits (CAVs). Examples of local floodplain ordinances can be found in our Resources section.

Source: FEMA 480 Publication: NFIP Floodplain Management Requirements

Explore Flooding Resources and Tools